26+ Compound interest mortgage

With 52 weeks in a year this amounts to 26 payments or 13 months of mortgage repayments during the year. For example refinancing from a 5 mortgage with 26 years left on it to a 4 rate but for 30 years will cause you to pay more than 13000 in additional interest.

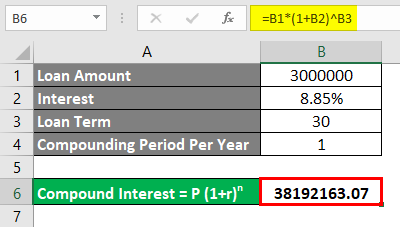

Calculate Compound Interest In Excel How To Calculate

Learn more about compound interest here.

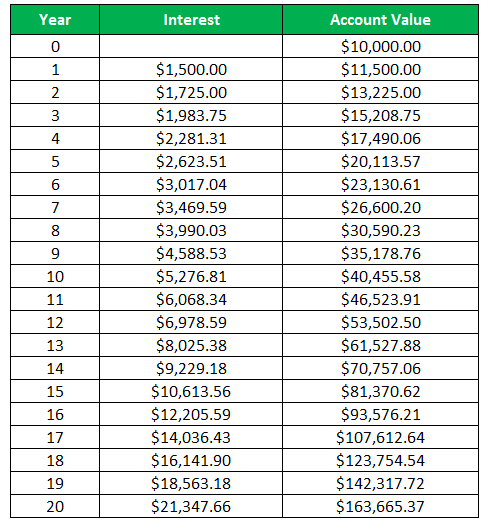

. The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. Calculating compound interest is actually quite simple. Usually mortgage interest gets levied on primary loans home loans secondary loans and line of credit etc.

Compound interest and your mortgage. This method is mainly for those who receive their paycheck biweekly. The formula is as follows.

The small 1000 loan version over five years given in our example showed a saving of almost 200 close to 20 of the principle. What does this factor mean in a mortgage loan. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month.

888 474-0404 Licensed by the. Compound interest investors and mortgage borrowers have something in common. The amount payable includes the principal amount and interest.

Mortgage interest in Canada is compounded semi-annually. This means that while you might be making monthly mortgage payments your mortgage interest will only be. B P x 1 RN N x T Each component of the.

For example you might want to calculate mortgage interest for a mortgage of 500000 with monthly payments of 2500 at a 3 mortgage rate. Use the following formula to find out your compound interest mortgage repayments. The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term.

Thus the interest of the second year would come out to. The longer unpaid loans sit the. Compound interest helps you save more faster.

A relatively straightforward mathematical formula can be used to calculate the total sum of compound interest that will be paid on a mortgage loan. Toggle Navigation 888 452-0335 Apply Now. 110 10 1.

Mortgage compound interest means additional interest has been added to the initial loan. They are both rate hunters who keep an eye on the market for conditions they can take advantage of. The number of times.

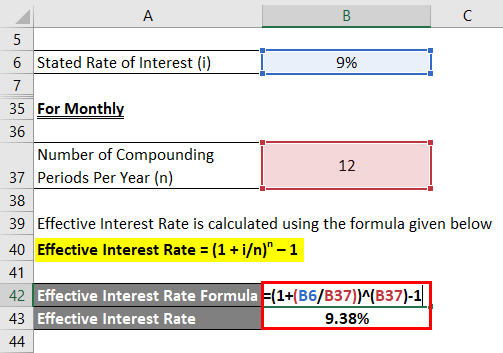

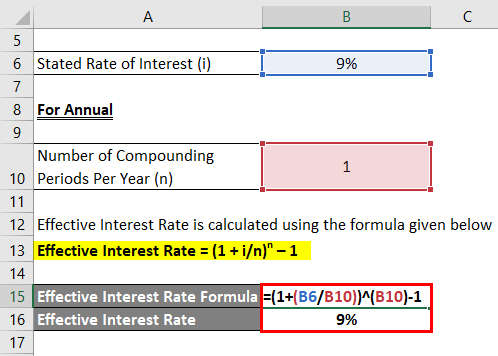

Effective Interest Rate Formula Calculator With Excel Template

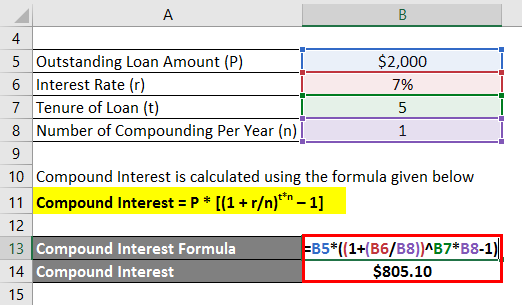

Compound Interest Example Practical Examples With Formula

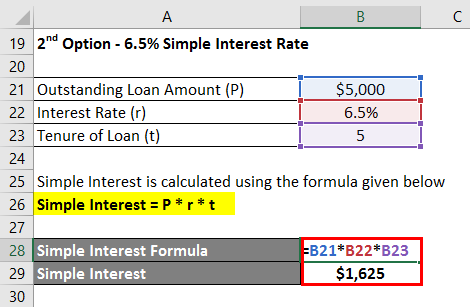

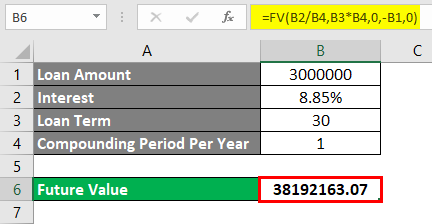

Interest Formula Calculator Examples With Excel Template

Effective Interest Rate Formula Calculator With Excel Template

Daily Compound Interest Formula Calculator Excel Template

Interest Formula Calculator Examples With Excel Template

Effective Interest Rate Formula Calculator With Excel Template

Interest Formula Calculator Examples With Excel Template

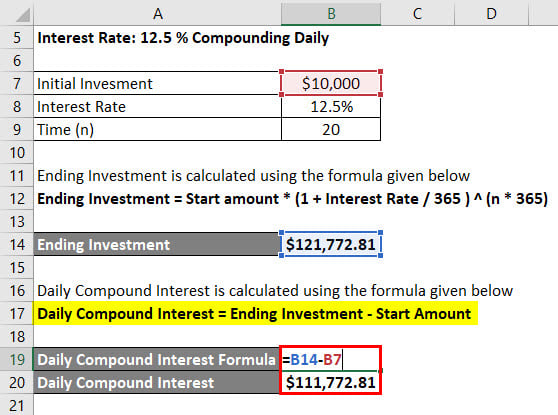

Daily Compound Interest Formula Calculator Excel Template

Daily Compound Interest Formula Calculator Excel Template

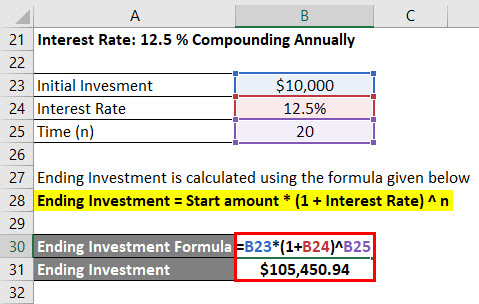

Calculate Compound Interest In Excel How To Calculate

Daily Compound Interest Formula Calculator Excel Template

Daily Compound Interest Formula Calculator Excel Template

Calculate Compound Interest In Excel How To Calculate

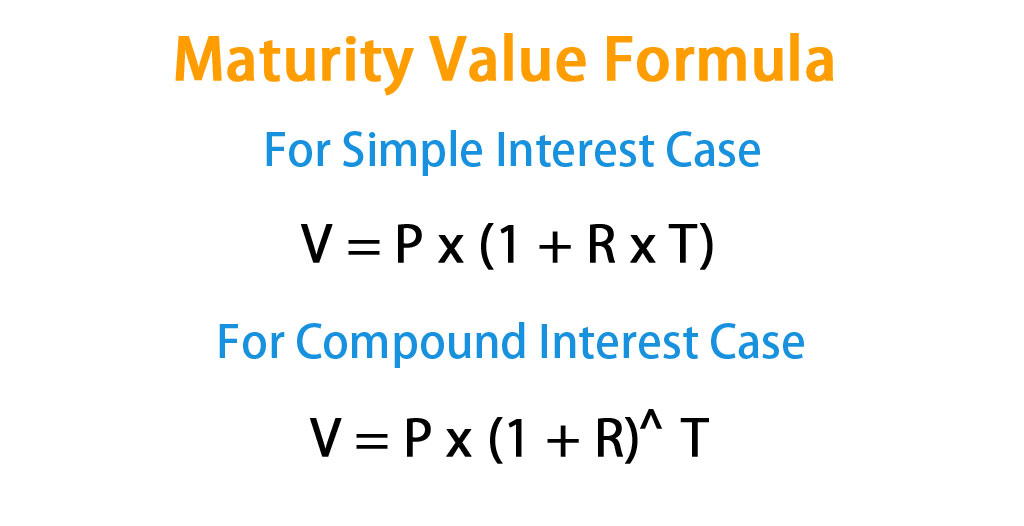

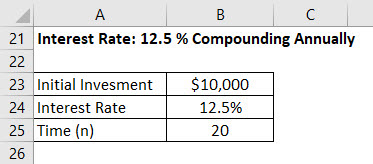

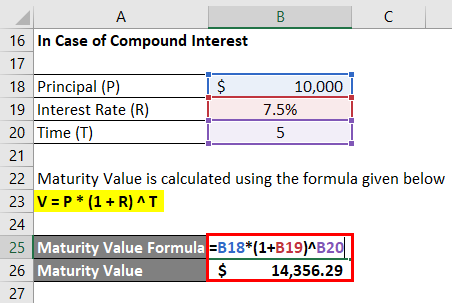

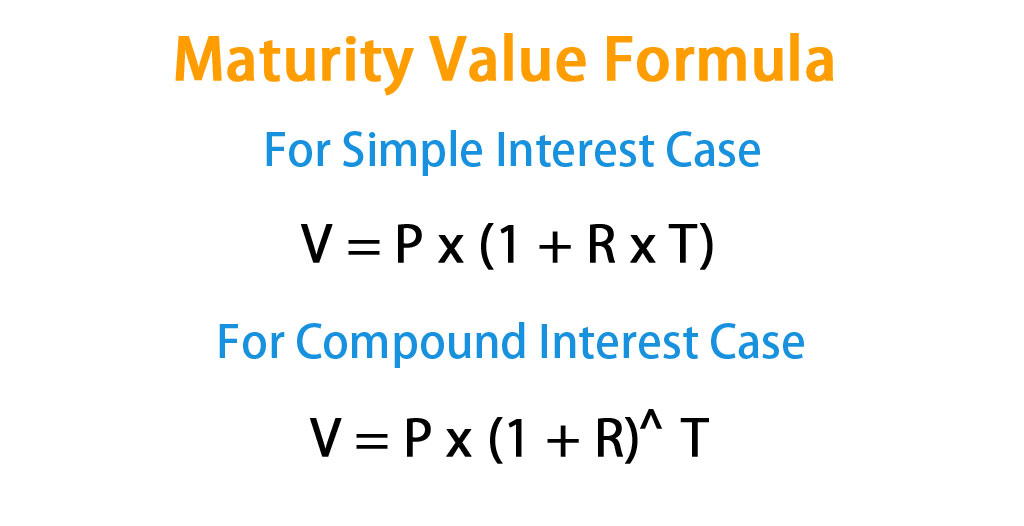

Maturity Value Formula Calculator Excel Template

Maturity Value Formula Calculator Excel Template

Maturity Value Formula Calculator Excel Template